when will i see my unemployment tax refund

I filed as soon as I could at the end of January and I still havent gotten anything from the state the online tool to check says theyre still. It is not your tax refund.

What To Keep In Mind About Your Unemployment Tax Refunds Wztv

Viewing your IRS account.

. If the IRS determines you are owed a refund on the unemployment tax break it will automatically send a check. Unfortunately an expected income tax refund is property of the bankruptcy estate. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

As a result jobless benefits up to 10200 for individuals earning less than 150000 per year are exempt from tax. Tax refunds on unemployment benefits to start in May. Approval and loan amount.

Heres a list of reasons your income tax refund might be delayed. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. By Anuradha Garg.

IR-2021-71 March 31 2021 To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer. Therefore if you received unemployment income in. You wont be able.

Your tax return has errors. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. The American Rescue Plan Act which was enacted in March exempts up to 10200 of unemployment benefits received.

Taxpayers who have access to a Touch-tone phone may dial 1-800-323-4400 within New Jersey New York Pennsylvania Delaware and. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. The IRS has sent 87 million unemployment compensation refunds so far.

Loans are offered in amounts of 250 500 750 1250 or 3500. Many filers are able to protect all or a portion of their income tax refunds by applying their. A quick update on irs unemployment tax refunds today.

The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment. You filed for the earned income tax credit or additional child tax credit. This is an optional tax refund-related loan from MetaBank NA.

Can you track your unemployment tax refund. Using the IRS Wheres My Refund tool. 22 2022 Published 742 am.

This is the fourth round of refunds related to the unemployment compensation. New Jersey State Tax Refund Status Information.

:max_bytes(150000):strip_icc()/1099g-b89de84cce054844bd168c32209412a0.jpg)

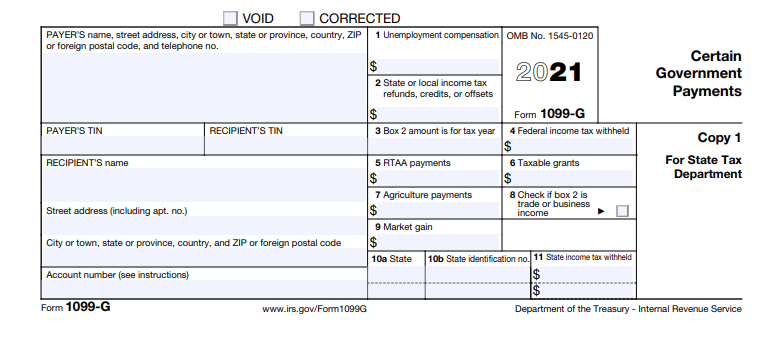

Form 1099 G Certain Government Payments Definition

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Accessing Your 1099 G Sc Department Of Employment And Workforce

Unemployment Taxes What To Know For The 2021 Tax Year

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Where S My Tax Refund Irs Reportedly Holding 30 Million Returns For Manual Processing Al Com

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Irs Unemployment Tax Refunds 4 Million More Going Out This Week King5 Com

Unemployment Are Benefits Taxed Income Fingerlakes1 Com

I M Confused By My Transcript What Does This Mean For Dates 4 15 Codes 766 And 768 Is This My Refund Because I Think They Are Missing Refundable Credits My Refund Should Be

Irs Automatically Sending Refunds To People Who Paid Taxes On Unemployment Benefits The Washington Post

Free Unemployment Tax Filing E File Federal 100 Free

Questions About The Unemployment Tax Refund R Irs

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

/https://static.texastribune.org/media/files/9e39efec91f8d75616c08256f08c9a6d/TWC%20Unemployment%20Illo%20Final%20PPTT.JPG)

Texas Unemployment Tips And A Guide For Navigating A Confusing System The Texas Tribune

Covid 19 Relief Bill Now Makes 2020 Unemployment Tax Free Wtol Com